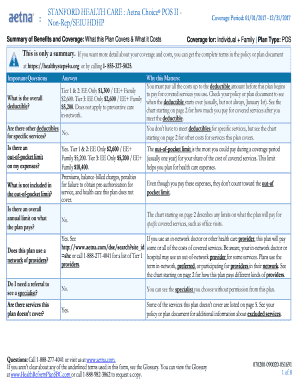

156-753006 1 of 7 Summary of Benefits and Coverage: What this Plan Covers & What You Pay for Covered Services SALESFORCE.COM, INC.: Aetna Choice® POS II - PPO Coverage Period:. A deductible is the amount you pay for coverage services before your health plan kicks in. Install ms office 2019 in windows 7. After you meet your deductible, you pay a percentage of health care expenses known as coinsurance. It's like when friends in a carpool cover a portion of the gas, and you, the driver, also pay a portion. A copay is like paying for repairs when something.

Aetna Choice POS II

The Aetna Choice POS II Plan is a network plan that gives you the freedom to select any licensed provider when you need care. It provides the highest level of benefits. This plan offers both in-network and out-of-network benefits; however, the plan’s reimbursement is higher when you use an in-network provider.

How Aetna Choice POS II Plan Works

Under the Aetna Choice POS II Plan, you may receive care from any licensed health care provider. You are not required to select a primary care physician (PCP) and no referrals are required for specialty care. When you need care, simply choose the appropriate doctor and make an appointment.

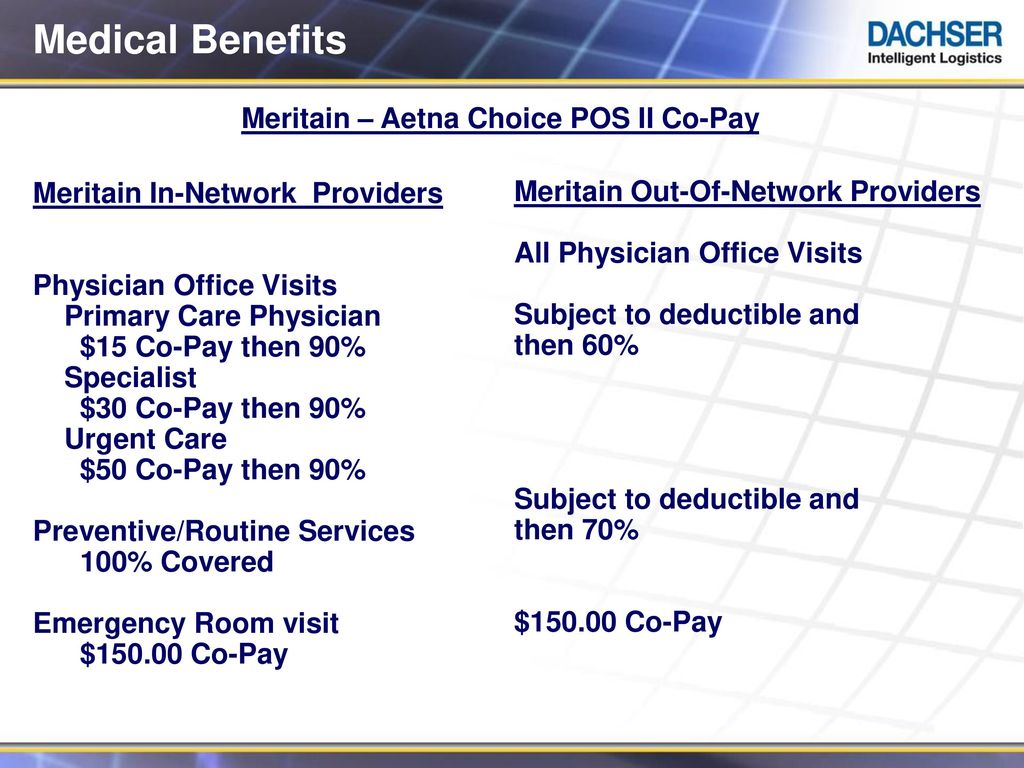

The Aetna Choice POS II Plan has two levels of benefits:

- In-Network Benefits - When you use in-network providers, you pay a fixed dollar amount, called a copayment (or copay), for doctor’s office visits and routine exams. For other services, you pay a lower deductible and the plan pays a larger share of your expenses. In addition, the in-network provider files claims for you and takes care of the plan’s precertification requirement(s) for hospital admissions.

- Out-of-Network Benefits - If you use an out-of-network provider, you will receive a lower level of benefits and you must meet a higher deductible. The plan pays a smaller share of your expenses. In addition, you must file your own claims and call Aetna when your doctor recommends care that must be precertified.

Staying In-Network

While you are free to use any provider, you save money when you use in-network providers.

If your doctor refers you to another provider (such as a specialist), be sure to ASK if the provider belongs to the network. If he or she doesn’t, benefits will be paid at the lower, out-of-network level AND only up to what Aetna determines to be the reasonable charge for the service. You’ll be billed for any amount that exceeds the reasonable charge.

The Aetna Network

Do I Need A Referral With Aetna Choice Pos Ii

The Aetna Choice network is large and comprehensive. It consists of primary care physicians and specialists ranging from cardiologists, podiatrists, and OB/GYNs to oncologists, ophthalmologists, and orthopedists. Facilities such as hospitals, urgent care centers, and labs also belong to the network. To find preferred providers near you, visit www.aetna.com.

Prescription Drug Benefits

When you enroll in one of the Aetna medical plan options, you’ll automatically have prescription drug coverage through Aetna and Express Scripts. This program includes a Formulary Management Program that uses a “four-tier” copayment approach to covered drugs and is designed to control cost for you and the plan. Click here to learn more about prescription benefits.

Is the Aetna Choice POS II Right for Me?

You should choose the Choice POS II plan if:

- You are willing to pay higher out-of-pocket costs in exchange for more choice. This includes higher per paycheck premiums.

- You need open access to any licensed health care provider.

- You are open to controlling your health care costs by using in-network providers and receiving higher benefits.

- You want to be able to visit specialists without getting referrals from a PCP.

Review your claims and expenses for the previous year at www.aetna.com. (login required). Reviewing your medical expenses may help you determine the coverage that is best for you and your family.

Aetna Choice POS II Plan Resources

Aetna Choice POS II Health Savings Account (HSA)

The Aetna Choice POS II Health Savings Account (HSA) is a high-deductible health plan, or “HDHP.” The Aetna Choice POS II HSA combines traditional medical coverage with a tax-free health savings account and consists of these key components:

- You must pay the deductible before the plan begins to pay. The deductible is the amount of eligible medical and prescription drug expenses you must pay each plan year before the plan begins to pay a percentage of those expenses.

- 100% coverage for preventive care when provided by an in-network physician. There is no cost to you or your account.

- Lower monthly premiums than traditional health insurance plans.

- A Health Saving Account (HSA) savings account established through the Benefit Strategies that can be used to pay health care expenses. You and Carnegie can deposit tax-free contributions (subject to federal limits).

All the features and benefits of Aetna Choice POS II HSA are designed to make health care expenses more manageable for employees. Auto clicker for mac no download 2020. Additionally, using this plan can save you money overall with the interest earned and tax advantages given to deposits and qualified withdrawals in an HSA. Game winning eleven 2012 for pc free download.

How the Plan Works

The Aetna Choice POS II HSA Plan has two levels of benefits:

- In-Network Benefits - When you use in-network providers, you pay a fixed dollar amount, called a copayment (or copay), for doctor’s office visits and routine exams. For other services, you pay a lower deductible and the plan pays a larger share of your expenses. In addition, the network provider files claims for you and takes care of the plan’s precertification requirement(s) for hospital admissions.

- Out-of-Network Benefits - If you decide to use an out-of-network provider, you will receive a lower level of benefits and you must meet a higher deductible. The plan pays a smaller share of your expenses. In addition, you must file your own claims and call Aetna when your doctor recommends care that must be precertified.

Staying In-Network

- While you are free to use any provider, you save money when you use in-network providers.

- If your doctor refers you to another provider (such as a specialist), be sure to ASK if the provider belongs to the network. If he or she doesn’t, benefits will be paid at the lower, out-of-network level AND only up to what Aetna determines to be the reasonable charge for the service. You’ll be billed for any amount that exceeds the reasonable charge.

- The Aetna Choice network is large and comprehensive. It consists of primary care physicians and specialists ranging from cardiologists, podiatrists, and OB/GYNs to oncologists, ophthalmologists, and orthopedists. Facilities such as hospitals, urgent care centers, and labs also belong to the network. To find preferred providers near you visit www.aetna.com.

Prescription Drug Benefits

When you enroll in one of the Aetna medical plan options, you’ll automatically have prescription drug coverage through Aetna and Express Scripts. This program includes a Formulary Management Program that uses a “four-tier” copayment approach to covered drugs and is designed to control cost for you and the plan. Click here to learn more about prescription benefits.

High Deductible Plan Right for Me?

A high-deductible health plan can be a good option for those who need only preventive care and do not expect to need to pay for prescriptions or frequent visits to the doctor. But they can also make sense for someone with a chronic condition since there are often no additional copays and coinsurance payments once the deductible has been met. Review your claims and expenses for the previous year at www.aetna.com. (You will need to log in to see your claims and expenses). Reviewing your medical expenses may help you determine the coverage that is best for you and your family.

Aetna Choice POS II HSA Plan Resources

Aetna Choice Pos Ii Eob

Aetna Choice POS II HSA Plan Tools